Trading Crypto on Spot vs. Margin: Which Is Right for You?

When I look at the crypto trading landscape, I see two fundamental approaches that define how most people interact with digital assets: spot trading and margin trading. Both involve the same basic activity of buying and selling cryptocurrencies, but they operate on completely different mechanics and offer vastly different risk-reward scenarios depending on what you're trying to accomplish.

The distinction between these two methods isn't just academic — it's the difference between owning your coins outright and borrowing money to amplify your bets. One approach lets you sleep soundly at night knowing you can't lose more than you put in, while the other can either multiply your gains or wipe out your account faster than you might expect.

I'm going to walk through how spot and margin trading work in practice, what makes each approach appealing or terrifying depending on your perspective, and how you can get started with both on VALR.

What Is Spot Trading in Crypto?

Crypto spot trading is the simplest way to buy and sell cryptocurrencies, where you purchase digital assets like Bitcoin or Ethereum at their current market price and immediately own them outright. When you execute a spot trade, the cryptocurrency is transferred directly to your wallet right away, giving you full ownership of the coins you just bought. Think of it like buying anything else—you pay the asking price, you get the product, and it's yours to keep, sell, or hold for as long as you want.

When you engage in spot trading, you are buying the actual cryptocurrency. If you buy 1 BTC, you own 1 BTC, which is then held in your exchange wallet or can be withdrawn to an external address. This direct ownership is a key characteristic of spot trading. You are using your own capital to make these trades; for instance, if you want to buy $1,000 worth of ETH, you need to have $1,000 (or its equivalent in another currency like USDT or USDC) available in your account.

Spot trading is often favoured by beginners due to its simplicity and relatively lower risk compared to leveraged trading. It allows traders to capitalise on price movements by buying low and selling high. For example, if you buy 1 BTC for 100,000 USDT on VALR and the price later rises to 105,000 USDT, you can sell your BTC for a 5,000 USDT profit (before fees). The primary risk is the potential for the asset's price to fall below your purchase price.

What Is Crypto Margin Trading?

Crypto margin trading is a method where you borrow money from an exchange to buy more cryptocurrency than you could afford with just your own funds. You put down a smaller amount of your own money as collateral, then the exchange lends you additional funds to multiply the size of your trade, which can amplify both your potential profits and losses. Think of it like buying a house with a mortgage — you put down a deposit and borrow the rest, except in this case you're borrowing to buy more crypto than your wallet balance would normally allow.

For example, if you have $1,000 and want to open a $5,000 position in BTC, you could use 5x leverage. You provide your $1,000 as the initial deposit, and VALR facilitates the additional $4,000. If the price of BTC moves in your favour, your profits are calculated on the total $5,000 position, thus amplifying your potential gains.

However, leverage is a double-edged sword: it also amplifies potential losses. If the market moves against you, your losses are also based on the larger, leveraged position, and you could lose your initial margin much faster.

Margin trading allows for both long positions (betting the price will go up) and short positions (betting the price will go down). Shorting involves borrowing a digital asset, selling it, and hoping to buy it back at a lower price to profit from the difference.

A key aspect of margin trading is the margin call. If your position moves significantly against you and your margin level (the ratio of your equity to the required margin) falls below a certain threshold (the maintenance margin), the exchange will issue a margin call, requiring you to add more funds or close your position to cover potential losses. Failure to meet a margin call can lead to forced liquidation of your collateral.

Crypto Spot Trading vs. Crypto Margin Trading: Exploring the Key Differences

Crypto spot and margin trading differ significantly in their mechanics, risk exposure, and potential outcomes. Understanding these distinctions is crucial for choosing the right approach for your trading style.

Here's a table summarising the key differences:

| Feature | Spot Trading | Margin Trading |

|---|---|---|

| Definition | Immediate purchase/sale at current market prices. | Borrowing funds to trade larger positions than own capital. |

| Leverage | No leverage used | Yes, leverage is used to amplify potential gains and losses. |

| Ownership | Direct ownership of the purchased crypto assets. | No direct ownership of the full leveraged position amount. |

| Risk Level | Generally lower; maximum loss is the capital invested. | Higher due to leverage; losses may exceed the initial margin of a position, and the chance of a margin call increases drastically with higher leverage. |

| Potential Returns | Based on actual asset price movement. | Amplified returns possible due to leverage. |

| Complexity | Simpler, more straightforward for beginners. | More complex, involves understanding margin, leverage, liquidation. |

| Capital Required | Full amount of the trade. | A fraction of the total position size (initial deposit or margin). |

| Going Short | Not possible directly. | Possible, allowing profit from falling prices. |

| Interest Costs | None. | Yes, interest is typically charged on borrowed funds. |

When to Place a Spot and When to Place a Margin Trade?

Choosing between spot and margin trading depends heavily on your investment goals, risk tolerance, market outlook, and trading experience. Neither is universally better; each serves different purposes.

Spot trading is often preferred by:

Beginners: Its simplicity and the absence of leverage make it a more forgiving entry point into crypto trading. The risk is limited to the capital invested.

Long-term HODLers: Those who believe in the long-term appreciation of a cryptocurrency and want to own the underlying asset directly often use spot markets for accumulation.

Risk-averse traders: If your priority is to minimise risk and avoid the complexities of liquidation and margin calls, spot trading is generally more suitable.

Trading less liquid altcoins: For many smaller altcoins, margin trading options may not be available, making spot trading the only avenue.

On the other hand, you may consider margin trading in the following cases:

Seeking to amplify potential profits: If you have a strong conviction about a short-to-medium-term price movement and understand the risks, leverage can magnify your gains (and losses).

Looking to short crypto: Margin trading allows you to short-sell digital assets, which is not possible in standard spot trading. This can be useful in bear markets or for hedging.

Hedging existing positions: If you hold a significant amount of crypto on the spot and are concerned about a short-term downside, you could open a short margin position to offset potential losses.

Capital efficiency (with caution): Experienced traders might use margin to make their capital go further, opening larger positions than they could with their spot balance alone. This requires rigorous risk management.

It's crucial to remember that margin trading significantly increases risk. Responsible use involves understanding leverage, setting stop-losses, and never investing more than you can afford to lose.

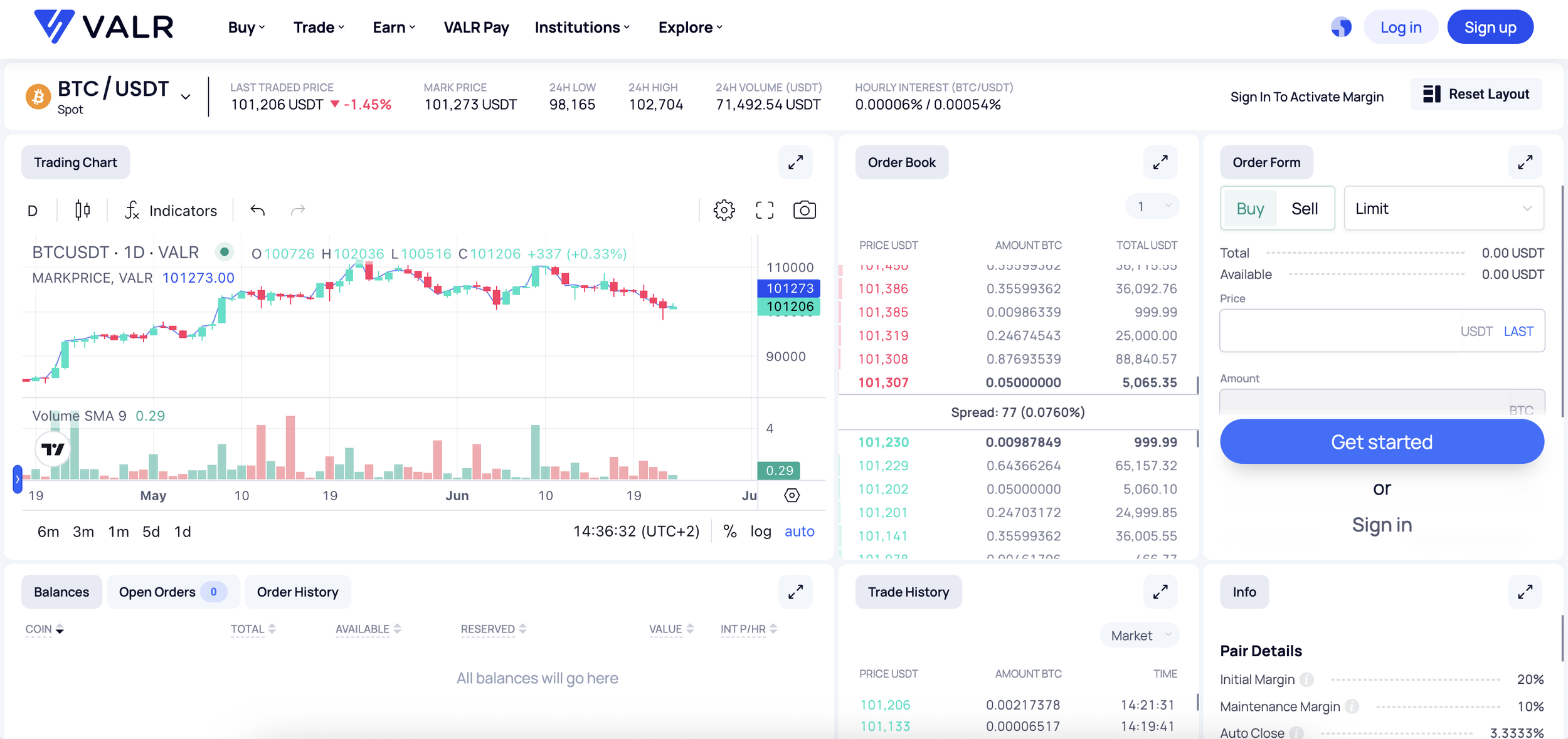

How to Trade Crypto on VALR's Spot and Margin Markets

VALR is a trusted and reputable platform for both spot and margin trading crypto, catering to a wide range of trading needs and experience levels. With a user-friendly interface and robust features, getting started is straightforward for anyone.

VALR provides access to over 50 spot trading pairs, allowing you to buy and sell a wide range of cryptocurrencies with immediate settlement. For those looking to amplify their potential gains, VALR offers spot margin trading with up to 5x leverage on select pairs, using BTC, ETH, USDC, and USDT, among other assets, as collateral. Our margin engine ensures seamless debt management and offers cross-collateralisation within individual subaccounts.

Here's a simple guide to placing spot and margin trades on VALR:

Create a VALR account and verify it.

Deposit funds to your VALR account.

Navigate to the "Trade" section and select either "Spot" or "Margin," and then choose your desired pair (e.g., BTC/USDT).

Use the trading widget on the right to place your order. For margin trades, you'll need to select your desired leverage and ensure you have sufficient collateral allocated to your margin wallet or subaccount.

Review your order details carefully and confirm the trade. Remember to implement risk management tools like stop-loss and take-profit orders, especially for margin trades.

Ready to explore crypto trading with the flexibility of spot and the potential of margin?

Frequently Asked Questions

-

Spot trading involves buying or selling cryptocurrencies at the current market price for immediate settlement and direct ownership. Margin trading allows you to borrow funds to open larger positions than your own capital, using leverage to amplify both potential gains and losses.

-

The margin level is the ratio of your equity to the required margin in a margin trading account. If it falls below a certain threshold (maintenance margin), the exchange may issue a margin call, requiring you to add more funds or close your position to cover potential losses.

-

Spot trading is simpler and involves direct purchase or sale with your own capital, giving you ownership of the asset, and is generally lower risk. Margin trading uses borrowed funds (leverage), does not give you full ownership of the leveraged position, is more complex, and carries higher risk, including the possibility of losses exceeding your initial deposit.

-

If you have $1,000 and use 5x leverage to open a $5,000 BTC position, you provide your $1,000 as collateral and borrow $4,000. Profits or losses are calculated on the full $5,000, so gains (and losses) are amplified compared to spot trading. If the market moves against you, you could lose your $1,000 much faster than in spot trading.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate. VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.