How to Diversify Your Crypto Portfolio

Important Note: This article is for educational purposes only and should not be construed as financial advice.

I've been watching crypto hit $3.88 trillion in market cap this September, up about 19% this year, and the growth opportunities are undeniable. The numbers are impressive, but they come with the volatility that defines this asset class and can create significant portfolio swings. The standard response to this problem is diversification, which in crypto means not concentrating all your capital in a single asset or following the latest trend without proper risk assessment.

In this article, I'll walk you through how diversification actually works in crypto, from spreading investments across different market sectors to some of the newer strategies people are using to generate returns while managing risk. I'll cover sector allocation, DeFi earning opportunities, and when you might want to rebalance your holdings to build something that won't give you heart palpitations every time you check your phone.

What Is Crypto Portfolio Diversification?

In simple terms, crypto portfolio diversification is the practice of spreading your investments across a variety of different digital assets to reduce your exposure to any single asset's performance. It's the practical application of the age-old saying, "Don't put all your eggs in one basket."

A concentrated crypto portfolio might only hold one or a few assets, like Bitcoin and Ethereum. This approach offers the potential for high returns if those assets perform well, but it also carries considerable risk; a downturn in a single asset can have an outsized negative impact.

In contrast, a diversified portfolio holds a wider range of assets across different sectors. This strategy aims to smooth out returns, as the positive performance of some assets can help offset the negative performance of others. This can help you create a more stable and balanced portfolio over the long term.

How to Diversify Your Crypto Portfolio

Achieving effective diversification goes beyond simply buying many different coins. It involves a strategic approach to allocation, considering not just which assets you hold but also how they function within the broader crypto ecosystem and how you can use them to generate returns.

Diversify Across Multiple Market Sectors

A cornerstone of diversification is spreading your investments across the various sectors that make up the crypto market. Each sector has different use cases and risk profiles, and they often respond differently to market trends. Allocating funds across these areas can help protect your portfolio from sector-specific downturns. Among many others, examples of sectors include:

Blue-Chip Coins: These are the largest and most established cryptocurrencies, like Bitcoin (BTC) and Ethereum (ETH), which often form the foundation of a portfolio due to their relative stability (compared to small-cap coins) and widespread adoption.

Decentralised Finance (DeFi): This includes governance and utility tokens for protocols that offer financial services like lending and trading (e.g., UNI, AAVE).

Stablecoins: Assets like USDT and USDC are pegged to fiat currencies, providing a low-volatility safe haven to hold capital during market turbulence.

Real-World Assets (RWAs): This growing sector involves tokens that represent ownership of tangible, off-chain assets like real estate or private credit.

Exchange Tokens: Tokens issued by exchanges that may offer benefits like reduced trading fees or other platform-specific utilities.

DeFi Earning Strategies

Diversification isn't just about what you buy; it's also about what you do with your assets. Instead of simply buying and HODLing, you can participate in DeFi to generate additional returns, creating diverse income streams within your portfolio. Popular strategies include:

Lending: You can lend your crypto assets to other traders and earn hourly interest. On VALR, you can lend assets like BTC, ETH, USDT, and more at a competitive annual percentage rate (APR).

Staking: By locking up your tokens in a Proof-of-Stake network, you help secure its operations and earn rewards in return. VALR offers simple staking for assets like Solana (SOL) and Avalanche (AVAX), handling the complexities while you earn passive income.

Yield Farming: This is a more advanced DeFi strategy where you execute various farming strategies, which generally include providing your crypto assets to liquidity pools on decentralised exchanges to earn transaction fee rewards and staking them to farm platform tokens. While potentially offering higher returns, yield farming also comes with more complex risks, such as impermanent loss.

Gain Exposure to General Market Assets

To diversify further, you can look beyond native crypto assets and gain exposure to traditional markets through tokenisation. This allows you to blend the stability of established asset classes with the efficiency of the blockchain.

Examples include tokenised gold via assets like Tether Gold (XAUt), which are 1:1 backed by physical gold, offering a classic inflation hedge in a digital format. Moreover, tokenised stocks like xStocks (recently launched on VALR) offer price exposure to leading U.S.-listed companies like NVIDIA and Tesla. These 1:1-backed tokens allow you to diversify into the global stock market directly from your crypto portfolio.

Employ Advanced Risk Management

For more experienced traders, hedging can be an effective way to manage risk. This involves taking a position that is designed to offset potential losses in another.

For example, a trader with a portfolio with large BTC holdings might open a short position on a Bitcoin futures contract. If the market declines, the gains from the short position can help offset the losses in the BTC portfolio, providing a layer of protection against broad market downturns.

If Needed, Rebalance Your Crypto Portfolio

Diversification isn't a one-time setup; it requires regular maintenance. Over time, market movements will cause the value of your holdings to shift, potentially unbalancing your original asset allocation. Rebalancing is the process of periodically buying or selling assets to return your portfolio to its intended risk profile.

During a bull market, a period of time where the majority of investors are buying and asset prices are rising, some investors may opt for a more aggressive approach with a stronger allocation of high-risk, high-reward assets. As these assets grow, you might rebalance by taking some profits and reallocating to more stable assets.

Conversely, during a bear market, a period of decline where market sentiment is overwhelmingly negative, other investors may favour a more defensive portfolio, allocated to blue-chip crypto assets or stablecoins with lower risk and reward profiles. Rebalancing here might involve buying more of your preferred long-term assets at lower prices.

Remember to DYOR

Regardless of your strategy, a few fundamental principles are essential for safe investing. Always do your own research (DYOR) before investing in any asset, looking beyond social media hype to understand its fundamentals.

Be vigilant against the constant threat of scammers and hackers, and use secure, regulated platforms. Most importantly, never invest more than you are willing to lose; a properly balanced portfolio should not cause you serious financial stress.

Putting It All Together

Diversification is a powerful strategy for managing risk and building a resilient crypto portfolio. By spreading your investments across different market sectors, incorporating DeFi earning strategies, gaining exposure to tokenised traditional assets, and regularly rebalancing, you can create a balanced approach that aligns with your financial goals.

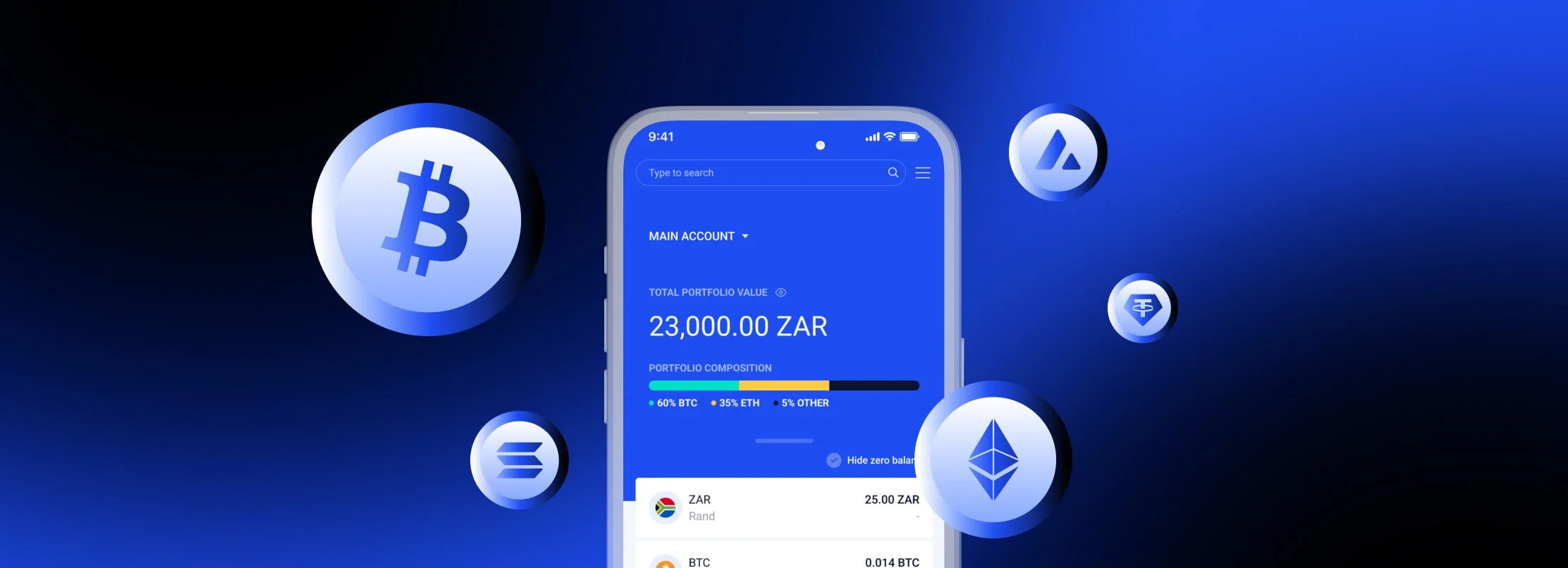

For investors looking to build a diversified portfolio, VALR offers an ideal platform. With access to over 100 crypto assets across a wide range of market sectors, stablecoins, and tokenised products like XAUt and xStocks, VALR provides all the tools you need. Plus, with passive income opportunities through staking and lending, you can create multiple streams of return within a single, secure, and regulated ecosystem.

Ready to build your diversified crypto portfolio? Create an account on VALR to get started!

Frequently Asked Questions

-

You should allocate your crypto portfolio by spreading your investments across different market sectors, such as blue-chip coins (like Bitcoin and Ethereum), DeFi tokens, stablecoins, real-world asset tokens, and exchange tokens. Consider both the role of each asset and how they work together in your portfolio. Advanced strategies like staking, lending, and even gaining exposure to tokenised stocks or commodities (such as xStocks or Tether Gold) can further diversify your holdings and help manage risk according to your personal financial goals and risk appetite.

-

It is advisable to rebalance your crypto portfolio regularly, such as quarterly or semi-annually, or whenever significant market movements alter your original asset allocation. Rebalancing involves buying or selling assets to restore your portfolio to your intended risk profile. During bull or bear markets, you may wish to adjust your holdings more frequently to maintain the right balance between high-risk assets and stablecoins or blue-chip cryptocurrencies, based on your investment strategy and risk tolerance.

-

Yes, diversifying your crypto portfolio is generally considered good practice. Diversification helps reduce your exposure to the risks of any single asset or sector, smoothing out returns and making your portfolio more resilient to market volatility. By holding a mix of assets across various sectors and employing different earning strategies (such as staking and lending), you can better manage risk and create multiple streams of return. However, it remains vital to do your own research, avoid overexposure to any one asset, and never invest more than you are prepared to lose.

Risk Disclosure

Trading or investing in crypto assets is risky and may result in the loss of capital as the value may fluctuate. VALR (Pty) Ltd is a licensed financial services provider (FSP #53308).

Disclaimer: Views expressed in this article are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.